Most Popular

-

Internet of Things for the Oil & Gas Industry

Industry experts are discovering smart alternatives to drive core business processes with automation.. -

Benchmarking in Oil & Gas Industry

For a modern nation Oil and gas exploration and production is very important. Exploration and produc.. -

Machine Learning and Artificial Inteligence in Oil & Gas Industry

Machine learning has now gained global recognition as an opportunity to gather large volumes of info..

RELIABILITY IN THE OIL & GAS SECTOR

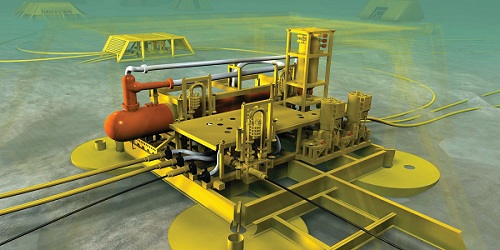

Nearly a third of the assets in the O&G sector have been in operation for over two decades now, with a majority operating past their expected useful life. Moreover, operations undertaken at extreme temperature and pressure conditions, such as drilling in the Arctic region or at sub-sea levels, or business expansion in heavily populated areas, further strain these assets.

O&G enterprises are also under immense pressure to reduce risks and limit operating costs by adopting technology innovations. To increase their competitive potential, industry players are aggressively pursuing mergers and acquisitions to onboard affordable assets.

Additionally, they are aggressively exploring methods to increase the return on capital employed (ROCE) by assessing four key factors:

1. Capital employed assets and working capitalboth included

2. Costs incurred—both operating expenses and maintenance expenditure

3. Output levels—driven by availability, reliability, and productivity of oil plants

4. Risks involved—process safety, environment protection plans, and asset integrity.

To improve the ROCE, the cost of maintenance and operations needs to be reduced. However, stringent regulations and industry standards such as HSSE and RoHS, coupled with the need to ensure high asset availability, are driving maintenance and operational costs under balance.

CHARTING THE WAY

The machinery in an O&G enterprise experiences a considerable amount of equipment stress and chemical degradation, due to the impact of the different types of fluids involved.

- Through enterprise asset management, O&G companies can:

- Enhance operations across the value chain and extend equipment life

- Increase plant productivity by reducing downtime, limiting risks, controlling operating costs, and ensuring compliance with safety and regulatory norms.

- Understand how fluid changes will affect material performance to conduct asset life extension research that incorporates historical performance data.

This facilitates near accurate prediction of asset life and allows for better equipment design in the future. Materials assessment also helps predict corrosion cracks and coating erosion; corrosion analysis can predict pipeline damage and increase the life of an asset.

THE ASSET MAINTENANCE TRIAD

The Asset Maintenance Triad is a three-pronged approach for proactive asset maintenance that comprises risk-based inspection (RBI), reliability-cantered maintenance (RCM), and real-time condition monitoring (RTCM).

RBI is mainly applied in the case of static assets such as heat exchangers pressure vessels, and piping. It involves laying out an inspection plan driven by knowledge of equipment failure risk. This is a structured approach that includes collecting previous maintenance and inspection data, accessing process flow diagrams, marking material flows and identifying damage mechanism and corrosion flows.

RM, on the other hand, takes into account the current reliability and availability of assets to study failure events and their consequences.

RTCM involves round the clock monitoring of critical assets to better predict the possibility of failures. It helps in accelerating and streamlining the information exchanged with responsive incident management systems to enable timely issue resolution.